What increasing solar capacity means for prices

Too much of any one thing creates a problem.

On sunny days, when solar is all on there is more generation that the market can cope with.

This leads to lower prices in the middle of the day, as generators compete to sell their product to the reduced number of buyers – leading to lower prices.

This price competition leads to what is called cannibalisation as incremental production forces prices lower – impacting all generators that haven’t pre-sold their output.

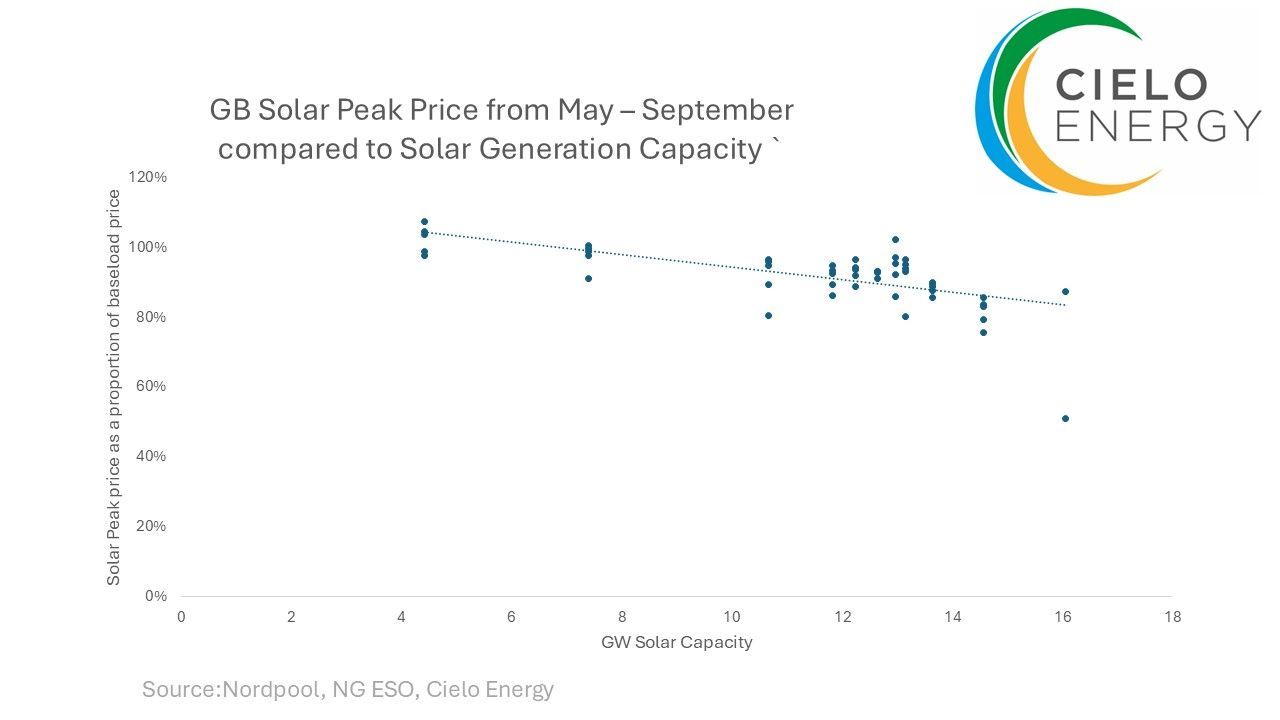

The scale of this cannibalisation can be hard to articulate clearly – although the below chart provides a simple view of the long term impacts.

Using day-ahead price data and installed solar capacity we looked at the changing relationship between solar peak (lunchtime) prices and installed capacity. Looking at the % price shape each day removes impacts of commodity price trends, allowing the isolated impacts to be more clearly seen,

The result – a very strong correlation between increasing solar capacity and falling peak prices

As solar capacity has increased since the mid 2010's, solar peak (lunch-time) prices have decreased in value relative to the flat baseload price. While the relationship isn't 1:1 there is a clear long-term trend in prices..

So what…

For generators – the falling value of ouput means either lower income for uncontracted volumes, or increasing attractiveness of co-location with demand or storage.

For storage operators – more price volatility is another opportunity for profit.

For consumers – lower prices make some days very cheap for those with dynamic time of use tariffs, others will see a diluted price averaging impact through their tariffs; whilst those with long term CPPA type structures may not see any benefit.

Green renewable schemes provide protection for many generators, so falling commodity prices lead to increasing non-commodity costs.

The changing electricity price picture is very real, creating opportunities and risks.

Thinking ahead and understanding the changing landscape is key to long term success.

Share this on social media

All Rights Reserved | Cielo Energy

REG NO: 11992760 | ICO REG NO: ZA757421