As the generation mix changes, we are all being impacted

As the electricity market evolves, we are all being impacted – although for many the effect may be masked, it is still there. The short term changes can be seen already, the longer term ones will be even larger.

Any contract, for any generator or consumer, whether fixed price, or some form of pass through / time of use is linked to the market value – and the market value is ultimately determined at a half hourly level at the time of delivery.

Fixed price contracts involve one side (the buyer of generation, or seller to consumers) taking a view of the future value of electricity at certain times of day in relation to standard product prices, as well as how much will be produced/ consumed.

The price weighting of fixed price contracts may hide the granular detail – but as the relative value and risk at different times of day change – so to does the value of any specific generation or consumption profile.

So what’s happening….

Price changes are happening at a fundamental level, demonstrated by the system balancing prices.

- Increasing solar generation across summer days leads to negative short-term prices at times, particularly if its windy.

- A more stressed system leads to more volatility in prices across the day.

Looking at the last 10 years of data, a clear change is clear to see…

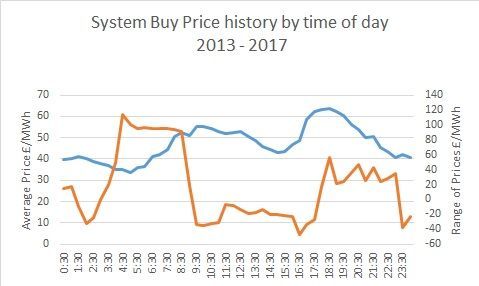

In the period 2013 – 2017

- The shape of energy prices across the day is recognisable against demand. Prices are higher at times of peak demand as may be expected.

- The range of prices is greatest over the night. Using mainly thermal generation, overnight prices were sensitive to changing fuel sources between gas and coal.

- The largest range in prices in any period was around £100/MWh over a 5 year period.

Since 2018…

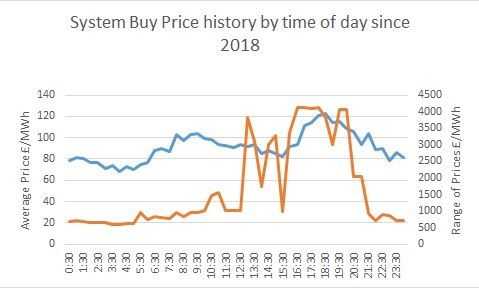

- Underlying prices are higher, and still recognisable as linked to system demand shape.

- The price range is greater across peak periods. As the system is more solar linked, managing this creates a more sensitivity to filling these gaps in generation

- The largest range in prices in any period is around £4000/MWh.

- While there have been changes in the way imbalance prices are calculated, there is an undeniable shift in market dynamics.

what…?

The fundamental changes in the electricity market are impacting the value available to all generators and consumers even now. Being aware of the changes can inform short term decisions.

Strategic decisions need to be made with an understanding of potential longer term impacts. There are opportunities to extract value through operating flexibly, and being ready for what is coming..

The scale of change is unprecedented, and seeking informed advice early can add significant value. Get in touch to discuss your needs.

Share this on social media

All Rights Reserved | Cielo Energy

REG NO: 11992760 | ICO REG NO: ZA757421