How to get what you want from flexible contracts

Flexible products are becoming much more common in the energy industry, creating opportunities if you know how to take them, whilst also creating sometimes hidden risks for the uninitiated.

They come in so many different forms – traditional supply flexible contracts, PPA, CPPA, VPP, Time of Use Tariffs – but all have a common thread; the price for some or all of the contract elements is not fixed at the time it is signed.

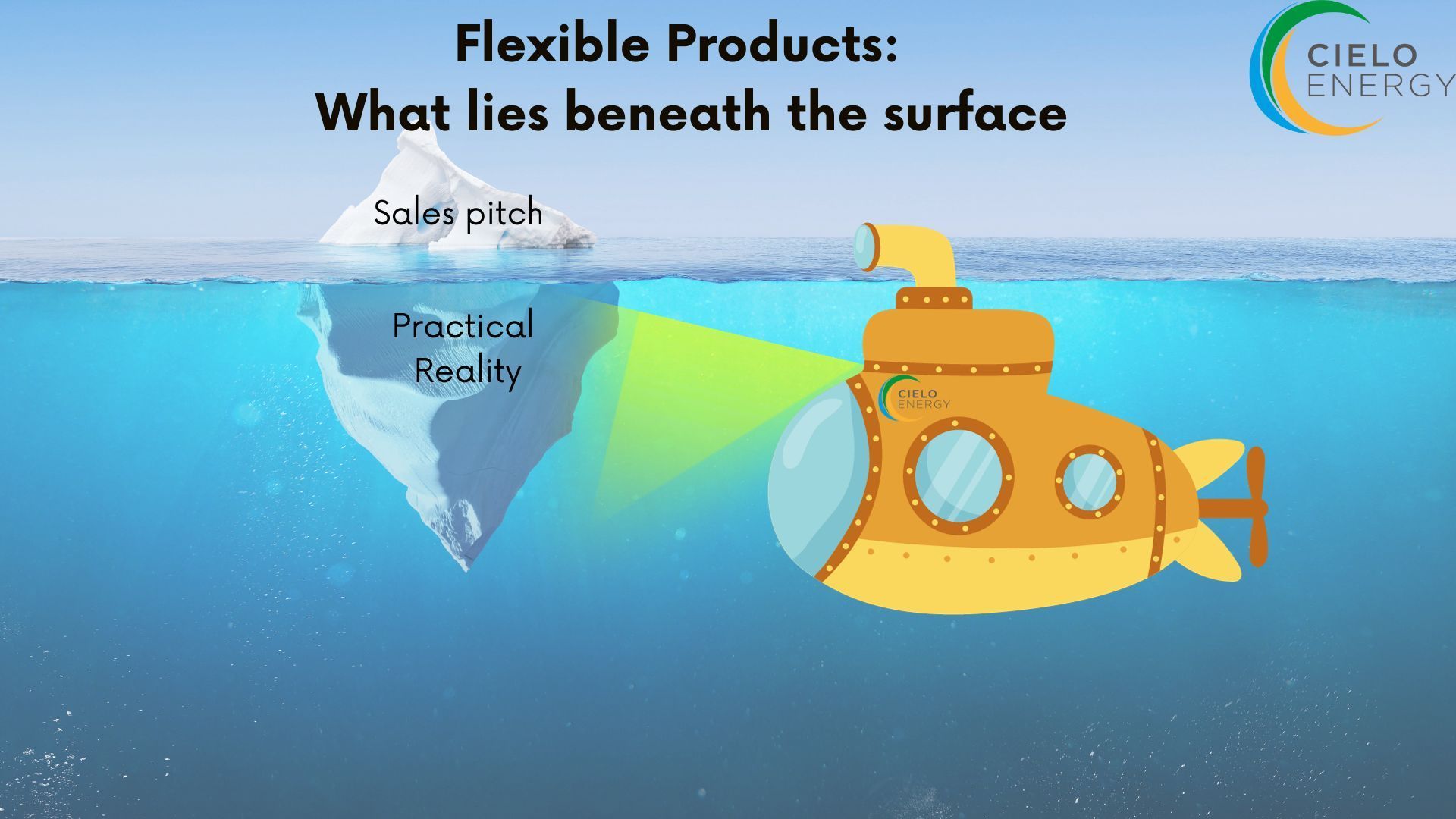

This has attractions for many, which are all part of the sales pitch, but it’s always worth a good look beneath the surface make sure the whole contract delivers what you’re expecting, and you know how to operate it.

Whether buying or selling, developing contracts or working with ‘standard’ flexible offerings, take time to look at the commercial and operational mechanics needed to get what you want.

Above the surface – it’s a one way bet

Flexible products create a contractual relationship between two companies – but do not specify the price.

This removes risk premia that are applied to fixed price contracts by the side that is offering the fix, in exchange for a pass-through of costs (see below..).

Having the flexibility to choose when to lock in commodity costs means its easy to draw charts of prices showing the ability to make large returns and best the market.

Flexibility to choose when to fix prices that align with your needs – creating as much certainty or risk as you wish at any time has a value – but knowing what to do with it… that’s a different matter.

Below the surface, it’s a bit more murky

Removing risk premia is like self-insurance. Rather than paying a third party to insure you (with the excess included) you take the risk yourself. That may be fine, but budgeting for (and clearly understanding) the uncertainty makes sense.

Flexible products don’t come with a user manual, so assembling a price is a combination of commodity and non-commodity costs built up over a period of time; potentially years before delivery. Having a clear view of what the objective is, and how to operate any contract is crucial.

The fundamental objective

All contracts have a single outcome – creating a price for any electricity consumed or generated.

Making it a price that is expected, and acceptable comes down to operating it effectively.

For help in achieving your objectives get in touch. If you're new to flexible contracts, or have been using them for years, and independent review can add significant value.

Share this on social media

All Rights Reserved | Cielo Energy

REG NO: 11992760 | ICO REG NO: ZA757421