An introduction to the potential impacts of LMP

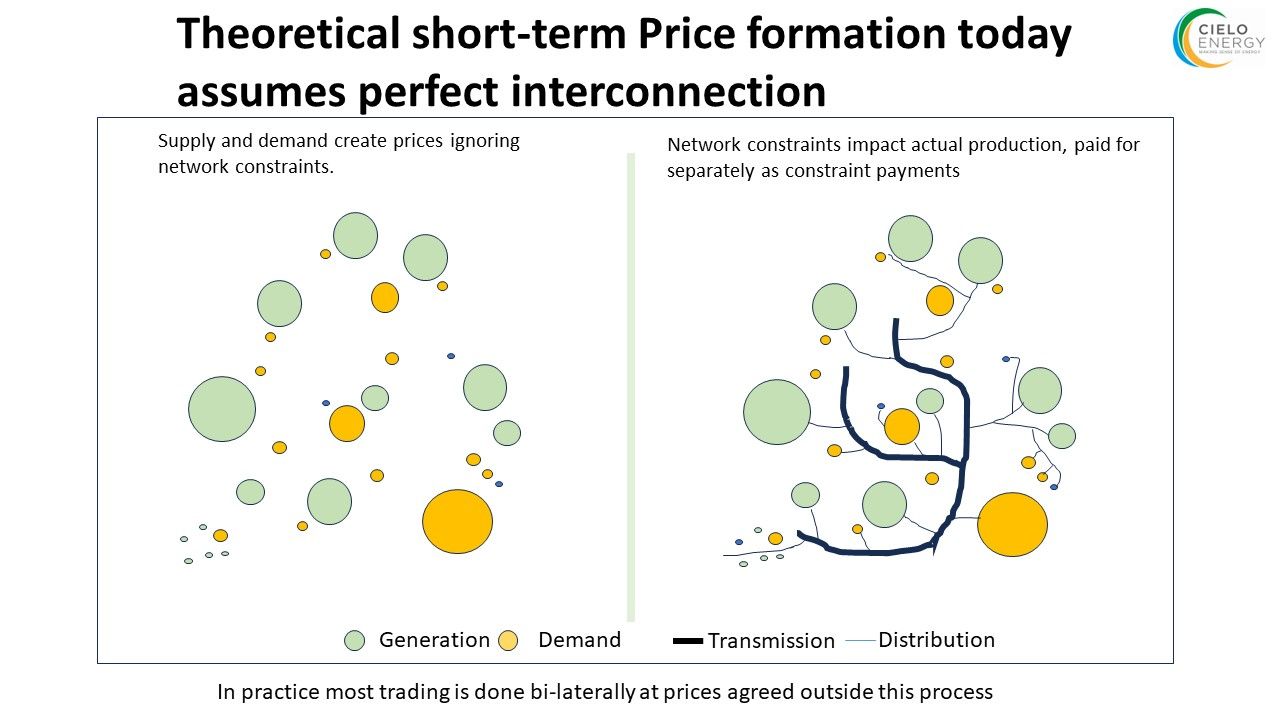

Historically GB electricity wholesale prices have been set at a single price for the whole market.

A hot issue in the GB electricity market at the moment is LMP. Although it sounds dull, all those with an interest should engage to help shape an outcome that works for all sides.

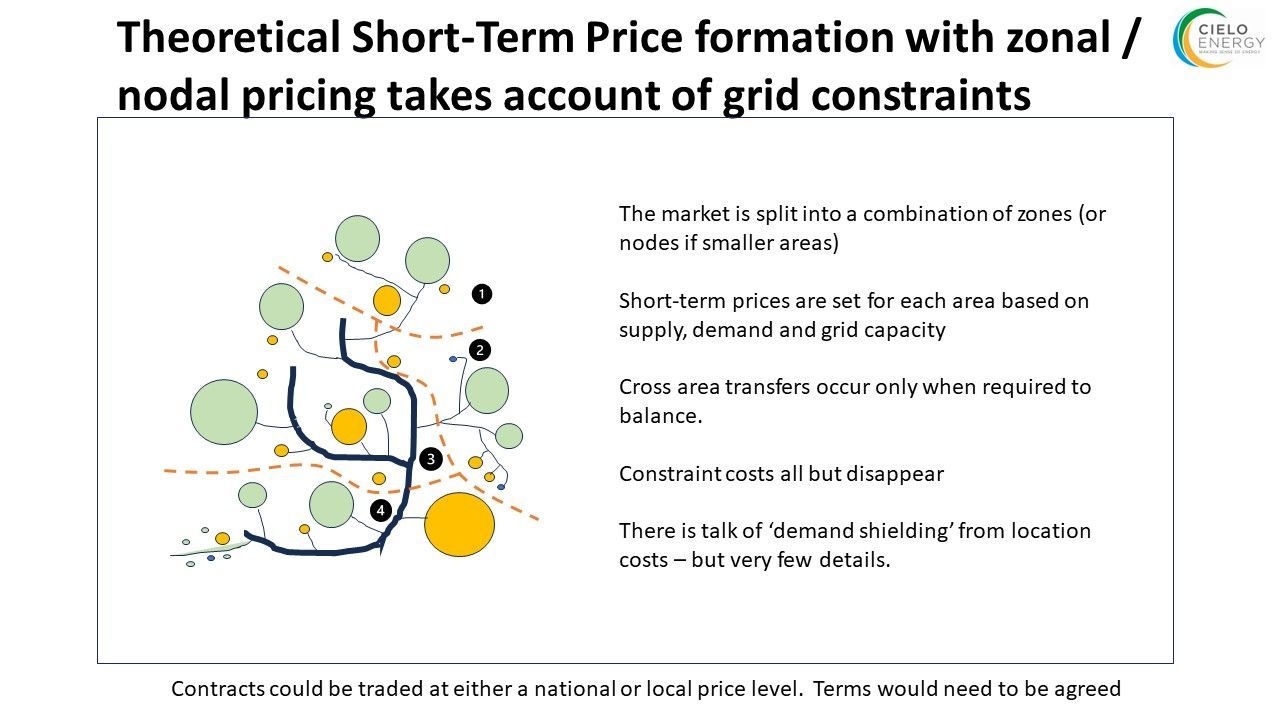

In simple terms, LMP as a shift from a single wholesale energy price for England Scotland and Wales to a more localised price. Conceptually simple, actually implementing the change (if it happens) will impact all generators, traders and consumers in some way.

Those arguing for it site the positive potential impacts from modelling undertaken by several econometric modellers (and also generally tend to be the likely beneficiaries).

For context Ofgem quotes a value to domestic users or c. £38/customer/year; with a counterfactual of full half hourly settlement being £11/customer/year. Neither of these are guaranteed, or large.

As an alternative counterfactual, pre-covid and the Ukraine war an average sized domestic customer could save £200/year simply by switching from a default tariff to a fixed tariff, yet half of customers didn’t switch.

𝐖𝐡𝐲 𝐜𝐨𝐮𝐥𝐝 𝐋𝐌𝐏 𝐛𝐞 𝐠𝐨𝐨𝐝…

Maximise use of local supply/demand flexibility – reducing local costs in areas of excess renewable generation by aligning generation and demand through tech driven scheduling.

Reduce need to upgrade networks through better utilisation- potentially saving significant re-enforcement costs.

𝐖𝐡𝐲 𝐜𝐨𝐮𝐥𝐝 𝐋𝐌𝐏 𝐛𝐞 𝐛𝐚𝐝 ….

Reduces traded market liquidity further -increasing financing costs for assets (making their output more expensive) and making it harder to fix prices

Removes national market pricing – all consumers pay for renewable subsidies, yet only some would receive the cheaper energy this may produce in some locations.

Complexity – there is almost no detail on how this would be done – leading to a hiatus in activity while details and consequences are worked out. All existing long term contracts would need to be amended, creating a huge risk to delivery of new services.

For those that were not around when NETA was implemented… the wholesale market essentially ceased trading for several months ahead of implementation. A similar event now, with a more diverse mix of asset owners and suppliers would have much wider consequences.

Whatever side of the fence you sit on, if electricity prices are material to your business (as a generator or consumer) its worth getting an understanding of the potential changes, engaging, and making sure your voice is heard; and you are ready for any changes.

Share this on social media