REMAking the GB electricity market - why, what and who wins?

The Review of the Electricity Market Arrangements (REMA) is underway, and DESNEZ recently reported back following the first industry consultation on setting out the scope.

In a nutshell, REMA seeks to put in place the rules necessary to deal with the changes in the electricity world to deal with an ever-growing amount of renewable generation to deliver net zero

The changing face of the electricity market is such that the rules that underpin it won’t work effectively in a more renewable dominated market of the future. There is a compelling need to do something to make the market more effective, although as with all change there are many ways of achieving the outcome (and different views on what the outcome should be).

The stated objective for the changes is ‘𝒕𝒐 𝒆𝒏𝒔𝒖𝒓𝒆 𝒕𝒉𝒂𝒕 𝒊𝒕 𝒊𝒔 𝒇𝒊𝒕 𝒇𝒐𝒓 𝒕𝒉𝒆 𝒑𝒖𝒓𝒑𝒐𝒔𝒆 𝒐𝒇 𝒎𝒂𝒊𝒏𝒕𝒂𝒊𝒏𝒊𝒏𝒈 𝒆𝒏𝒆𝒓𝒈𝒚 𝒔𝒆𝒄𝒖𝒓𝒊𝒕𝒚 𝒂𝒏𝒅 𝒂𝒇𝒇𝒐𝒓𝒅𝒂𝒃𝒊𝒍𝒊𝒕𝒚 𝒇𝒐𝒓 𝒄𝒐𝒏𝒔𝒖𝒎𝒆𝒓𝒔 𝒂𝒔 𝒕𝒉𝒆 𝒆𝒍𝒆𝒄𝒕𝒓𝒊𝒄𝒊𝒕𝒚 𝒔𝒆𝒄𝒕𝒐𝒓 𝒅𝒆𝒄𝒂𝒓𝒃𝒐𝒏𝒊𝒔𝒆𝒔.’

A noble desire, and one that is inherently difficult and will involve trade offs that politicians and regulators have avoided for much of the past 20 years (and have so far avoided in laying out the vision for what REMA needs to achieve).

Following the government’s consultation, the majority of feedback appears to favour evolution – as may be expected by incumbents, but will that satisfy those looking for something bigger, faster and more all-encompassing?

𝐓𝐡𝐞 𝐜𝐚𝐬𝐞 𝐟𝐨𝐫 𝐜𝐡𝐚𝐧𝐠𝐞

The current market rules were put in place in 2001 when the physical make-up of the market was very different than today. The changes illustrate the underlying need for some kind of reform.

𝟐𝟎𝟎𝟏

𝐆𝐞𝐧𝐞𝐫𝐚𝐭𝐢𝐨𝐧 was dominated by few large generation units, split between coal, gas and nuclear in broadly equal portion

𝐃𝐞𝐦𝐚𝐧𝐝 was broadly passive. The supply market had already been fully deregulated so consumers of all sizes could choose a supplier of their choice, but their ability to actively engage with the market was almost zero.

𝐅𝐚𝐬𝐭 𝐟𝐨𝐫𝐰𝐚𝐫𝐝 𝐭𝐨 𝐭𝐨𝐝𝐚𝐲...

𝐆𝐞𝐧𝐞𝐫𝐚𝐭𝐢𝐨𝐧 – the largest share in 2022 was gas with 39% , but nuclear has reduced to 16%, renewables makes up 39% and coal a mere 4%

𝐃𝐞𝐦𝐚𝐧𝐝 – at the end of 2022 there were nearly 700,000 electric vehicles on the road, 1.2 million rooftops with solar panels, 280,000 heat pumps and a growing level distributed generation and demand side participation in the wholesale market.

𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐦𝐩𝐚𝐜𝐭𝐬

The stresses and impacts of the changing face of the physical market are shown in the way the electricity market itself is acting:

- 𝐓𝐡𝐞 𝐦𝐚𝐫𝐤𝐞𝐭 𝐩𝐫𝐢𝐜𝐢𝐧𝐠 𝐦𝐞𝐜𝐡𝐚𝐧𝐢𝐬𝐦 𝐢𝐬 𝐛𝐞𝐢𝐧𝐠 𝐜𝐫𝐢𝐭𝐢𝐜𝐢𝐬𝐞𝐝

Like many markets, electricity pricing at a wholesale level is based on an implicit marginal pricing regime. That is to say that as supply and demand must be matched in real time, the price is set by the most expensive generation at that point, providing potentially large returns to other generators.

In a market with a growing share of near zero marginal price renewables, but where price is notionally set by gas this is a bad look for some. Consumers that are underwriting the renewable schemes are not benefitting from their current relative cost-effectiveness goes the cry.

The reality is more complex, and is more about badly designed subsidy schemes than anything else. However, it is popular, and speaks to splitting the market into renewable/ non-renewable and also to send signals to generators to locate in the ‘right’ place for the network.

This is a complex and sometimes emotive subject, but one that is likely to be at the heart of any REMA change.

Any change made here will impact every generator and consumer in one way or another, whether they have a long or short-term contract in place.

2. 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 𝐢𝐬 𝐟𝐚𝐥𝐥𝐢𝐧𝐠

Virtually all generation is now in receipt of some form of subsidy payment to underwrite its operation. This is reducing the importance of pure energy income, and also the term over which volumes can be fixed.

CfD generators are unlikely to ever sell more than 1 season (or even 1 day in the case of solar and wind) into the future as that is how their contracts work. Fossil fuel generators cannot be sure of how they will operate in the long run as they are increasingly marginalised by renewables, so have very limited ability to sell long-term hedges.

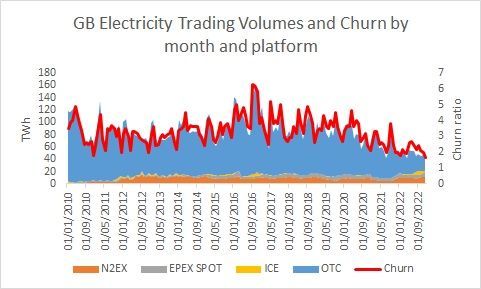

The drop in OTC liquidity shown in the graph below (Ofgem sourced) shows the falling trend in liquidity even accounting for Covid and the Ukraine impact on the levels of collateral required to trade. Overall market churn is no at less than 2 * physical demand, down from 3 /4 times only a few years’ ago.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐭𝐡𝐞 𝐥𝐢𝐤𝐞𝐥𝐲 𝐨𝐮𝐭𝐜𝐨𝐦𝐞?

There is a need to change, the big question really is whether its evolution or revolutionary change.

The calls for more granular pricing, more local markets, more ability to exploit technology may be more exciting to listen to than a more measured approach – and both are able to pull together analysis that makes their case.

Many of the arguments made in favour of more revolution and complex change are academically driven, whereas the evolutionary ones tend to be from current participants that operate in the market with today’s limitations – which is right is a matter of opinion.

While its hard to call what the exact effects might be, the financial and strategic impacts may be huge, and all sides of the market will feel some kind of impact of a fundamental shift.

𝐖𝐡𝐨 𝐦𝐢𝐠𝐡𝐭 𝐰𝐢𝐧?

In a surprise to nobody, the biggest winners may well be those arguing most strongly for the largest change… the market operator and tech companies…

The system operator is already set to take on the roll as Future Systems Operator to facilitate the change – and that will liekly lead to higher, guaranteed, and stable returns.

Higher complexity creates more opportunities for technology companies that can exploit the opportunities to provide flexibility.

Flexible assets/ consumers - Those that are able to participate in flexibility may benefit. The move towards rewarding active participation in the market looks to be unstoppable.

𝐖𝐡𝐨 𝐦𝐢𝐠𝐡𝐭 𝐥𝐨𝐬𝐞?

𝐈𝐧𝐯𝐞𝐬𝐭𝐨𝐫𝐬 – Long term PPAs provide secure income streams for investors, and secure costs for off-takers. If the market separates into renewable and non-renewable pricing the impact on energy value may change significantly, impacting both generators and off-takers.

Investors are also exposed to the potential risks of locational pricing, and what it might mean in terms of ability to hedge – adding risk to returns available. There is a risk that investment is harmed by changes that pass too much risk to generators.

𝐒𝐮𝐩𝐩𝐥𝐢𝐞𝐫𝐬 – Any change to the pricing mechanism may impact existing hedge transactions, and the products that can effectively be sold to customers. The changing risk profile could impact the business model.

𝐂𝐨𝐧𝐬𝐮𝐦𝐞𝐫𝐬 – Passive consumption will likely be more expensive, as the flipside incentive to be flexible is a penalty for being inflexible. How this will be reconciled with providing a fair outcome and benefits for all remains unclear, although payment for rewards to some parts of the market has to come from somewhere.

𝐒𝐨 𝐖𝐡𝐚𝐭?

REMA matters to the electricity market, and all its stakeholders. The fundamental changes it will bring will impact all stakeholders in one way or another.

Taking an early view of how this could work, the impacts it may have will be key to success for any business with a large financial stake in the electricity market.

Long term contracts may be impacted, and new approaches to risk management may be needed.

One thing that is certain, is that those that are best prepared, and engage early to help shape the debate are likely to get better outcomes.

Get in touch to discuss how we can help you,

Share this on social media

All Rights Reserved | Cielo Energy

REG NO: 11992760 | ICO REG NO: ZA757421