As prices stabilize, the scale of the change can be seen

𝐇𝐨𝐰 𝐝𝐫𝐚𝐦𝐚𝐭𝐢𝐜 w𝐚𝐬 𝐭𝐡𝐞 𝐞𝐥𝐞𝐜𝐭𝐫𝐢𝐜𝐢𝐭𝐲 𝐩𝐫𝐢𝐜𝐞 𝐬𝐡𝐨𝐜𝐤?

The energy price crisis has been well reported and there has been a price shock affecting all sides of the market – but how big is it?

As the price crisis starts to disappear into history, it is now possible to start looking at some kind of historical context for what we have been living through.

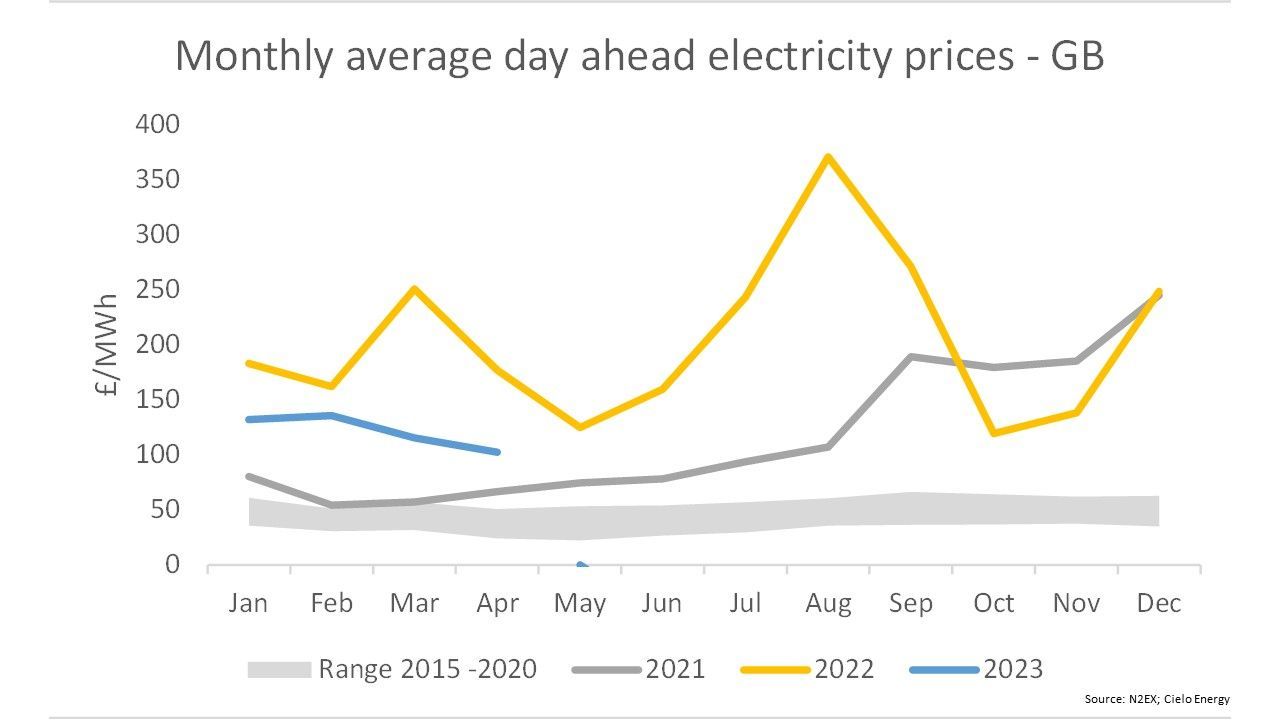

The chart shows day ahead N2EX prices with a 5 year range up to 2020 of normal energy market prices along with the last 3 years separated. These are day ahead rather than forward market prices, so show the value at delivery.

This shows is the level of price stretch, with prices accelerating way above the £50/MWh average for the whole of the last 2 years.

Its strange to note that the 𝐚𝐛𝐬𝐨𝐥𝐮𝐭𝐞 𝐡𝐢𝐠𝐡𝐞𝐬𝐭 𝐩𝐫𝐢𝐜𝐞𝐬 𝐰𝐞𝐫𝐞 𝐢𝐧 𝐦𝐢𝐝-𝐬𝐮𝐦𝐦𝐞𝐫 𝟐𝟎𝟐𝟐, rather than the usual deep winter. The cause was Europe’s dash to fill storage ahead of the winter in 2022, following the disconnection from Russia.

Prices in 2023 have headed towards more normal levels, although they were still double previous range in April.

𝑻𝒐 𝒑𝒖𝒕 𝒕𝒉𝒆 𝒑𝒓𝒊𝒄𝒆 𝒔𝒉𝒐𝒄𝒌𝒔 𝒊𝒏 𝒇𝒊𝒏𝒂𝒏𝒄𝒊𝒂𝒍 𝒄𝒐𝒏𝒕𝒆𝒙𝒕

An increase in the average price from £50/MWh to £200/MWh increases the total costs of electricity consumed by roughly £𝟒𝟓 𝐁𝐢𝐥𝐥𝐢𝐨𝐧 𝐚 𝐲𝐞𝐚𝐫.

Moving into the future, hopefully a more manageable price level will emerge, although a return to historic ranges is still a way off, and may never happen given other market changes…

𝐆𝐚𝐬 / 𝐞𝐥𝐞𝐜𝐭𝐫𝐢𝐜𝐢𝐭𝐲 𝐥𝐢𝐧𝐤𝐚𝐠𝐞

Gas will remain the marginal price fuel for electricity generation.

Moving across the summer of 2023, European gas demand for storage will be impacted by unseasonably high stocks after the warm winter of 2022… but the risks of price shocks remain as the whole continent is now reliant in securing short term LNG shipments.

𝐂𝐚𝐫𝐛𝐨𝐧 𝐏𝐫𝐢𝐜𝐢𝐧𝐠

Carbon prices are embedded within electricity prices, and as the cost of carbon goes up so does electricity. A great way for politicians to incentivise carbon reduction, or hide subsidies depending on your point of view.

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐩𝐥𝐢𝐭𝐭𝐢𝐧𝐠

There is a desire in some quarters to split the electricity market into sub-markets.

Splits in either fuel (separating renewable/ non-renewable) or location (geographical pricing) may or may not make overall prices cheaper. My money is it not reducing prices by the time the dust settles, but time will tell.

𝐏𝐫𝐢𝐜𝐞 𝐕𝐨𝐥𝐚𝐭𝐢𝐥𝐢𝐭𝐲

Average prices don’t take account of short-term volatility. As the grid decarbonises, the gap between the cheapest and most expensive periods in any day is likely to grow.

This accentuates the differential between flexible operations and inflexible generation/consumption, so simple averages may be less of a guide to achievable prices.

Whatever the future holds, be ready for more uncertainty!

Share this on social media

All Rights Reserved | Cielo Energy

REG NO: 11992760 | ICO REG NO: ZA757421